Most Goods and Services Tax (GST) and Quebec Sales Tax (QST) registrants overlook the following obscure rules, which may permit them to obtain GST and QST and refunds in the form of Input Tax Credits (ITCs) and Input Tax Refunds (ITRs) with respect to the sale of a passenger vehicle costing in excess of the prescribed capital cost income tax limits, at the date of acquisition.

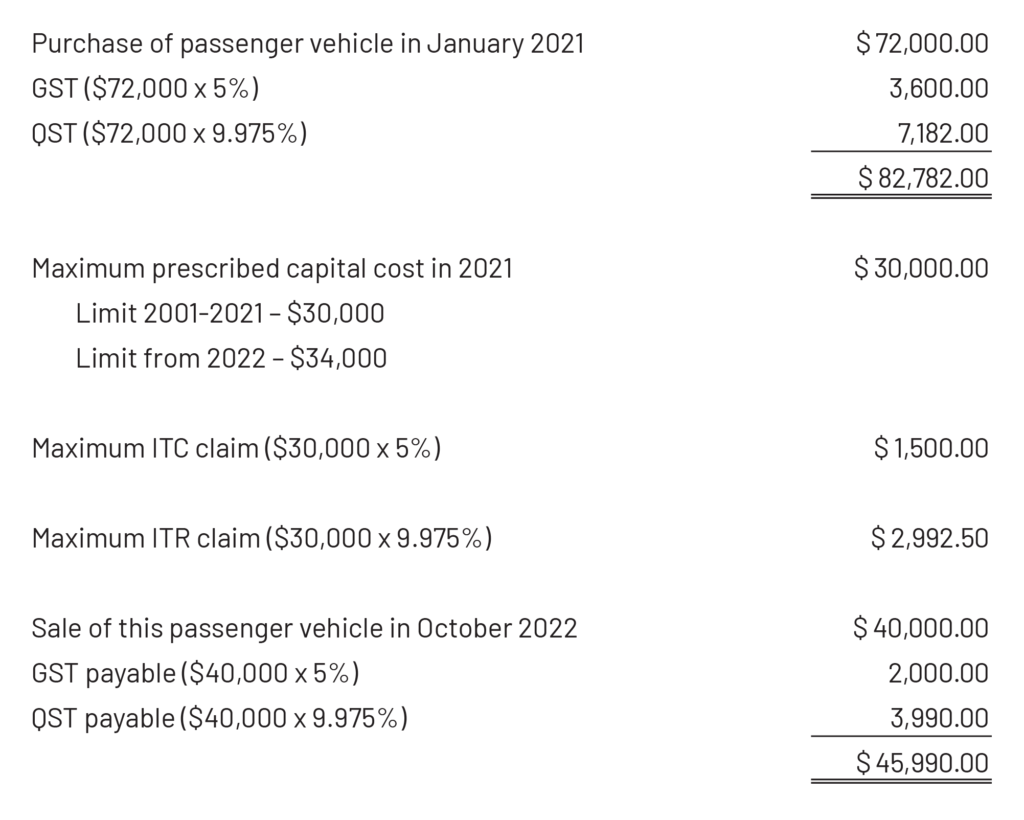

When a passenger vehicle is acquired, the cost of which exceeds the said limits, a registrant is not permitted to claim an ITC or ITR in respect of the GST and QST paid on the cost of the vehicle, exceeding the prescribed limits, as the example below illustrates.

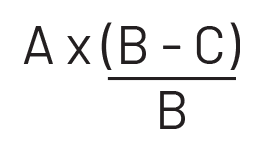

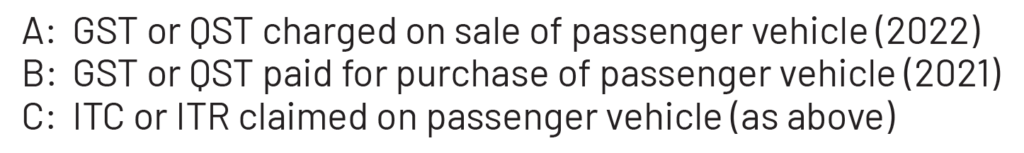

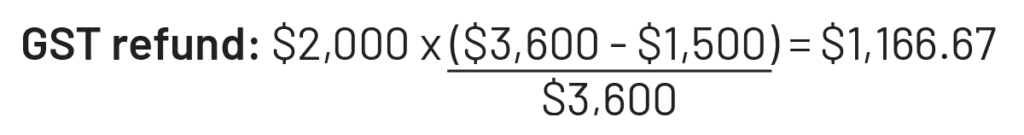

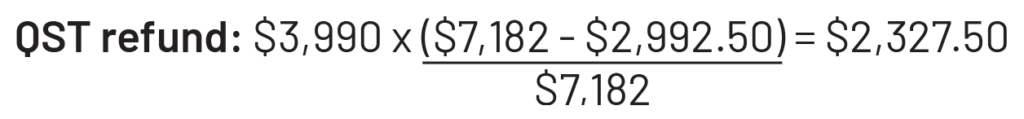

The following calculations using the above example will illustrate how a registrant may recover a portion of the GST and QST on the sale of a passenger vehicle.

Formula for ITC Calculation

Formula for ITR Calculation

Planning

If you have sold a passenger vehicle during the last four years (two years if you are a listed financial institution), you are still entitled to claim an ITC and/or ITR. You may claim an ITC (line 108) and ITR (line 208) on your GST/HST – QST Return. You must make your claim by the deadline for filing the return for the last reporting period ending within four years (or two years) after the first reporting period for which the expense was incurred.

We’re Here to Help

Still confused about the calculation of a potential GST and QST return after selling a passenger vehicle? Please do not hesitate to contact a member of our Tax Team.

The matters highlighted in this tax memo are presented in broad general terms and, of course, cannot be applied without consideration of all circumstances. The firm will be pleased to discuss with recipients the possible effects of these matters in specific situations.