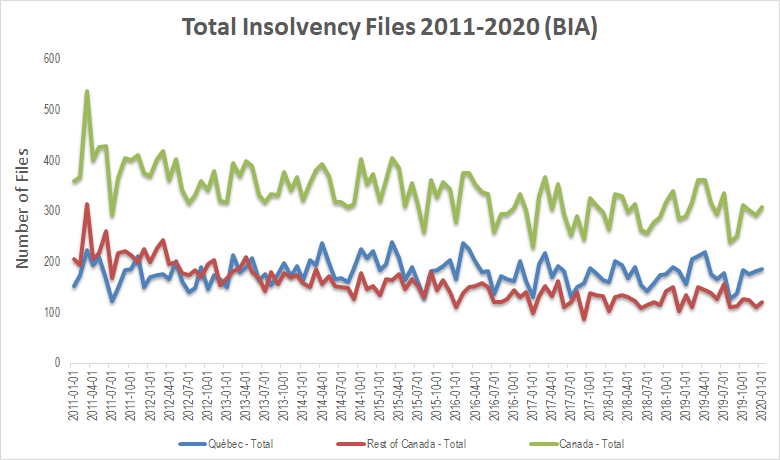

Canadian companies have not made much use of the Bankruptcy and Insolvency Act over the past 10 years1 likely due to years of growth spurred by abundant capital and easy access to credit.

Canadian companies have not made much use of the Bankruptcy and Insolvency Act over the past 10 years1 likely due to years of growth spurred by abundant capital and easy access to credit.

Unfortunately, 2020 will likely see a reverse of this trend. The COVID-19 pandemic is hitting the entire economic world on a global scale. In Canada, during the month of March alone, the TSX stock index lost nearly 20.0% (32.0% at its worst) of its total value, thousands of companies have temporarily closed and more than 1.5 million workers have applied for employment insurance following the government-ordered self-isolation and the shutdown of non-essential operations.

In response to this unprecedented crisis, important measures have been taken by key stakeholders. The Bank of Canada has reduced its policy interest rate by 1.5%, the Federal and Quebec governments have announced initiatives to help businesses and workers (the creation of the Canada Emergency Wage Subsidy, the Canada Emergency Business Account, the Business Credit Availability Program largely supported by Export Development Canada and the Business Development Bank of Canada and the ESSOR loan program promoted by Investissement Québec2, to name a few).

These measures are commendable and necessary to support the economy when businesses are sorely lacking in liquidity. While these measures announced by the two governments will help merchants temporarily, they will not solve any financial and operational problems that existed before the outbreak of the pandemic. The COVID-19 crisis provides a unique opportunity for these businesses to review their business model and take appropriate corrective measures.Companies facing short term cash problems can negotiate postponement of payments with their key suppliers. This will help stabilize cash outflow by spreading payments out over time, thus allowing them to re-start production and generate sales and receivables.

Forbearance agreements can be put in place with creditors, during which they agree to accept payment defaults and allow time to correct them. Banks and secured lenders often accept these agreements, pending the fulfilment of certain conditions, such as provision of additional collateral and, of key importance the establishment and implementation of a sound recovery plan.

There are obviously some issues that may prevent a viable turnaround under such a scenario, including the fact that it most likely will require approval from most if not all creditors. This may be very difficult, especially with suppliers that have a poor relationship with the company. It will also be challenging to obtain third-party financing, which generally requires first ranking security on assets of the company which are most likely already pledged to existing creditors.Canadian legislation provides for legal remedies for companies undergoing financial difficulties. The Bankruptcy and Insolvency Act (BIA), as well as the Companies’ Creditors Arrangement Act (CCAA), provide for the restructuring and or liquidation of financially-troubled companies.

- In the current liquidity crisis, the BIA allows an insolvent business to file a notice of intention to make a proposal to its creditors. Claims existing at the time insolvency proceedings are filed will be frozen and will be the object of a proposal to be filed at a later date (“Claims”). In the meantime, management remains in control of its business and benefits from a stay of proceedings in respect of the Claims. This process, which should not exceed 6 months, allows a business to put forward corrective measures to restore its profitability (termination of contracts, layoffs, etc.) under the supervision of an officer of the Court, namely the trustee.

- For larger corporations with more than $5 million in debt, the CCAAis another vehicle to help restructuring. The process is similar but enables large companies to perform complex restructuring. There is no statutory time limit under the CCAA to file a plan, as opposed to the maximum of six months under the BIA.

COVID-19 will most certainly bring great challenges to businesses in the coming months. In the current context, we shouldn’t be surprised if Canadian (and Quebec) companies use more often the BIA and the CCAA in the next few months than in the past 10 years in order to implement restructuring measures deemed necessary.Do not hesitate to contact one of our advisors if you have any concerns about the financial impact of COVID-19.1 Office of the Superintendent of Bankruptcy – January 2011 to January 2020. Includes only records filed under the BIA (excludes CCAA records).2 Subject to certain eligibility criteria, conditions and limits.