2019/12: Important Federal, Quebec and U.S. Reporting Deadlines for 2020

Important Federal, Quebec and U.S. Reporting Deadlines for 2020 In order to help you plan accordingly for 2020, we have compiled the important reporting deadlines that are required by the various levels of government. FEDERAL AND QUEBEC DEADLINES T1135 – FOREIGN INCOME VERIFICATION STATEMENT The deadline for filing form T1135 corresponds to the filing deadline […]

Term Sheet: What You Should Know Before Signing

While receiving a term sheet from your banker may seem like good news and a sign that your funding request is on the right track, it is important to know what the purpose of this document is and above all, how to decipher it.

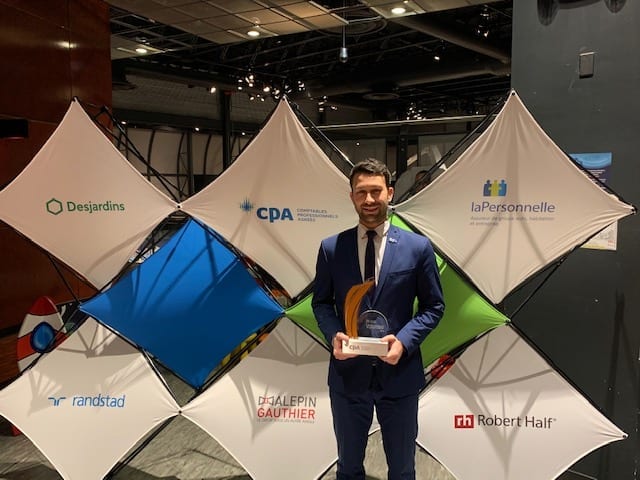

2019 CPA Volunteer Award: FL’s Matthew Chaussé Distinguishes Himself From His Peers

This year, the Montreal CPA chapter agreed that Matthew Chaussé has been going above and beyond the duties of the profession, lending a hand to several organisations, in addition to taking an active part in several fundraising activities.

2019 FL Fuller Landau Cedars CanSupport Dragon Boat Race & Festival: Over 600 paddlers take to the water to raise $425,000

More than 1000 participants and spectators attended the 14th edition of the FL Fuller Landau Dragon Boat Race & Festival benefitting the Cedars Cancer Foundation’s CanSupport program.

New Disclosure Requirements for Nominee Agreements and Deadline Extension

Revenu Quebec has issued new disclosure requirements for nominee agreements and has announced an extension to the filing deadline which was previously set for September 16th, 2019.

ASPE Update – Financial Instruments

Please note that this update applies to entities who currently issue Audited or Reviewed Financial Statements in accordance with ASPE. There are amendments to Section 3856 – Financial Instruments that come into effect for year-ends starting on or after January 1, 2020.Are you informed about how these changes will impact your financial statements?The changes […]

NEW REPORTING REQUIREMENTS – CBCA Corporations

We have recently been made aware of some changes made by the Federal Government. These changes will have an impact on the companies established under the federal law.The federal government has made changes to the Canadian Business Corporations Act (CBCA) whereby as of June 13, 2019, all CBCA corporations, except some distributing corporations, will be required […]

The Directors’ Liabilities in Case of Bankruptcy

The Directors of a corporation may be held personally liable of certain debts of the corporation. Upon the foreclosure of a corporation pursuant to a bankruptcy or receivership, should these debts not be entirely paid by the proceeds of the sale of assets, Directors could be forced to pay them personally. Here is a summary […]

2019/04/03 – Ernie Furt on Money Matters – 2019 Tax Season

FL Fuller Landau Tax Partner Ernie Furt on Money Matters with ScotiaMcLeod Senior Wealth Advisor Arnold Zwaig answering questions on 2019 Tax Season.

Our Top 4 Measures from the 2019-2020 Quebec Budget

Gradual elimination of the additional contribution for childcare over four years starting in 2019. Families with income below $78,320 will no longer pay the additional contribution and those over that threshold will pay a lower contribution not exceeding $13.20 a day. To encourage small and medium-sized businesses to retain workers aged 60 years and older, […]