On Saturday April 11, 2020 The House of Commons held a special assembly to obtain royal assent for Bill C-14, a second Act regarding certain measures in response to COVID-19 .

Many of the details surrounding the Canada Emergency Wage Subsidy (CEWS) program were already known, but the following summary should give you more information on many points that were still unclear.1. TARGET AND EXCLUSIONS

The following are eligible entities for the purpose of the Canada Emergency Wage Subsidy (CEWS):

- Corporations, other than those exempt from tax or public institutions

- Individuals

- Registered Charities

- Non-for-Profit Organizations

- Registered Charities

- Partnerships, all of the members of which are described above

2. ELIGIBILITY AND CONDITIONS

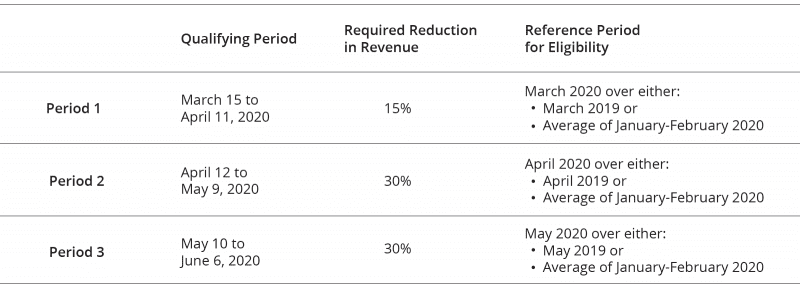

An eligible entity qualifies for the subsidy if it meets the revenue reduction indicated below for the given reference period and was registered with a payroll account with the CRA as of March 15, 2020.

If an eligible entity meets the conditions with regards to the decrease in revenue in respect of a particular reference period, then it is deemed to be eligible for the following reference period.

If the eligible entity meets the conditions with regards to the decrease in revenue in respect of the particular reference period, the entity can claim the wage subsidy for the wages and salaries paid during the related qualifying period.

An election must be filed to use the January-February 2020 period as the reference period and must be applied for the entire qualifying period.

3. QUALIFYING REVENUES

Qualifying revenues mean revenues from the sale of goods, rendering services and for the use by others of resources of the entity carried on in Canada, solely from arm’s length sources and excluding any extraordinary items and amounts on account of capital.

An election may be made, which must apply for all qualifying periods, to determine revenues based on the cash method (as opposed to revenue on an accrual basis).

There are special rules for corporate group in regards to the computation of revenues:

- Entities whose revenues are all or substantially all charged to other non-arm’s length entities can benefit from the subsidy by taking into account the sales reduction of the other entities.

- An affiliated group of companies (controlled by the same person, spouse of, or by same group of persons) can elect (all companies must elect) to determine their revenues on a consolidated basis. Conversely if a group of companies file consolidated statements, each company can determine their revenue separately provided all members do the same.

Additional rules apply for non for profits and charities:

-

- Charities include revenues from a related business, gifts and other amounts received in the course of its ordinary activities.

- Non for profits revenues include membership fees and other amounts received in its ordinary activities.

Both charities and non for profits may elect to exclude funding received from government sources from the revenues for all the reference periods.

4. AMOUNT OF SUBSIDY CALCULATIONS

The amount of subsidy on a weekly basis is to be calculated as follow. It will amount to the sum of the 4 items (no cap to the subsidy):

- The greater of:

- the least of:

- (i) 75% of eligible remuneration paid to the eligible employee in respect of that week

- (ii) $847, and

- (iii) if the eligible employee does not deal at arm’s length with the qualifying entity in the qualifying period, nil.

- The least of:

- (i) the amount of eligible remuneration paid to the eligible employee in respect of that week,

- (ii) 75% of baseline remuneration in respect of the eligible employee determined for that week, and

- (iii) $847

- the least of:

- Plus: refund of employer contribution (QPP, QPIP, EI) for eligible employee in respect of a week in the qualifying period, if the eligible employee is on leave with pay for that week.

- Less: the amount received by the eligible employee for each week in the qualifying period as a work-sharing benefit.

- Less: the amount received by the eligible entity with regards to the 10% temporary subsidy.

Employees not dealing at arm’s length that were hired on or after March 15, 2020 would not be eligible for the subsidy.

Eligible remuneration means any salary, wages or other remuneration other than, amongst other things, retiring allowance, stock options, taxable benefits and any amount that is paid in respect of a week in the qualifying period in excess of the employee’s baseline remuneration for which one of the main purposes would be to increase the amount of the subsidy.

Baseline remuneration means the average weekly eligible remuneration paid to the eligible employee by the eligible entity during the period that begins on January 1, 2020 and ends on March 15, 2020, excluding any period of seven or more consecutive days for which the employee was not remunerated.

Eligible employee means an individual employed in Canada by the eligible entity in the qualifying period other than individual who is without remuneration by the eligible entity in respect of 14 or more consecutive days in the qualifying period.

5. OTHER IMPORTANT CONSIDERATIONS

- The individual who has principal responsibility for the financial activities of the eligible entity will have to attest that the application is complete and accurate in all material respects.

- The application with any given qualifying period will have to be filed no later than September 30, 2020, through Canada Revenue Agency’s My Business Account portal, available in early May.

- Anti-avoidance rules on qualifying revenues are provided for in Bill C-14. Such rules provide for full reimbursement of subsidy plus penalty of 25% therefrom and can subject to the gross negligence penalty of 50% of the subsidy.

Consult our COVID-19 Resource Centre to stay on top of the latest government program announcements, and do not hesitate to contact our Crisis Relief Team, to help you make the calculations and related applications to various programs.