COVID-19 | March 31 CEBA Debt Forgiveness Deadline

It is important to note that the CEBA debt forgiveness amount is calculated on the highest amount drawn from your CEBA at any time up to and including a date to be determined by your financial institutions. You should discuss with your account manager at your financial institution to ensure to meet the program requirements in order to benefit from the forgiveness.

COVID-19 | Government Assistance: Know What You Owe – Update

Over the last several months many of us have received government aid, whether directly through CERB payments, forgivable loans, wage subsidies, rent subsidies and other payments. Are these payments taxable, and if so, how?

COVID-19 | Update: Home Office Expenses for 2020 Income Tax

Because of the COVID-19 crisis, both the federal and Quebec governments have put in place simplified procedures to be able to claim home office expenses.

COVID-19 | New 2020 Employer Reporting Requirements From CRA

Canada Revenue Agency (CRA) has recently announced additional reporting requirements for employers for fiscal year 2020 related to COVID-19 relief measures. There may be important action for you to be taken.

COVID-19 | Canada Emergency Rent Subsidy (CERS) Eligibility Decision Tree – Periods 1 to 3 (September 27 to December 19, 2020)

Since November 30, 2020, the CRA’s online platform, allowing claims to be filed under the CERS is available. Our decision tree will provide insights as to your eligibility and subsidy quantum you may get from the program.

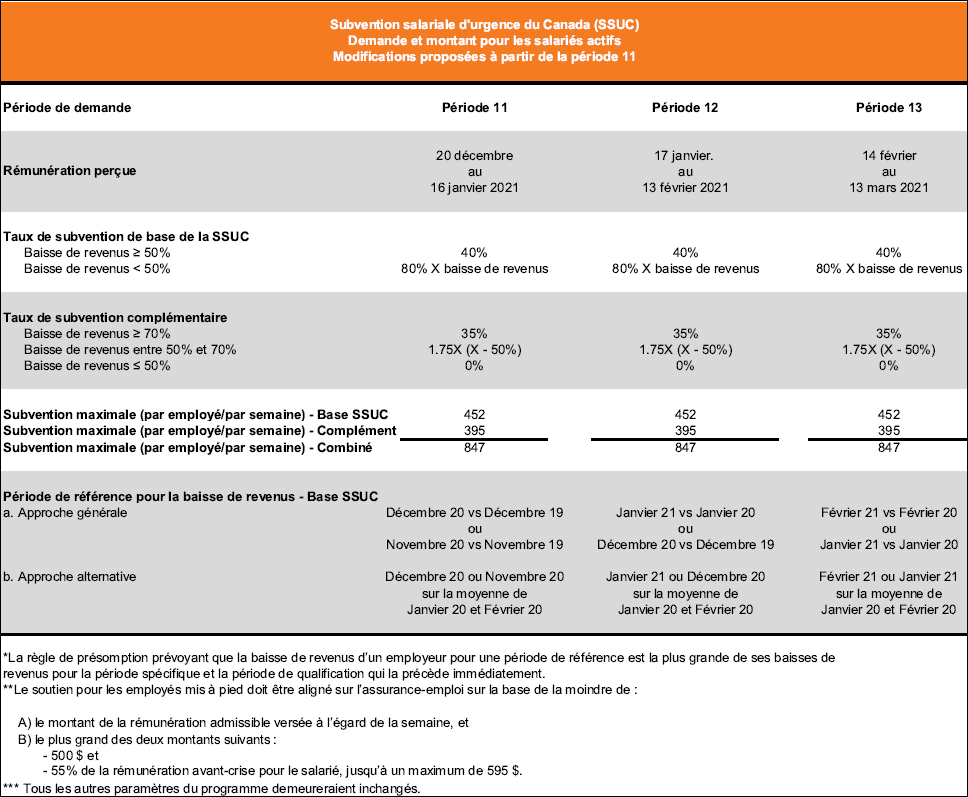

COVID-19 | CEWS and CERS Proposed Changes

On November 30, 2020, Canada’s Minister of Finance, Chrystia Freeland, released the “Supporting Canadians an Fighting COVID-19 : Fall Economic Statement 2020″ plan. This plan includes proposed changes that have yet to receive approval by the House of Commons and Royal Sanction from the Senate. Notwithstanding the foregoing, here is what you should know about […]

COVID-19 | Have You Reviewed Your Insurance Coverage Lately?

Sometimes a business is forced to shut down temporarily as is the case because of sanitary measures enforced by the government in relation to COVID-19. In these cases, some insurance coverage deemed as “business interruption” might apply.

COVID-19 | Governmental Measures – Archives

COVID-19 | Summary of economic measures announces by governments to help stabilize the economy during this challenging period.

COVID-19 | Home Office Expenses: What You Should Know

As most employees in Quebec started working from home in mid-March, many of them have been working from home for six months, and there is a prospect of claiming home office expenses for the 2020 tax season.

COVID-19 | Canada Emergency Wage Subsidy (CEWS) – July Update

On July 17, 2020, Canada’s Minister of Finance, Bill Morneau, announced the most anticipated proposed changes to the Canada Emergency Wage Subsidy (CEWS) program. These are proposed changes that have yet to receive approval by the House of Commons and Royal Sanction from the Senate. Notwithstanding the foregoing, here is what you should know about […]