2019/01: Tax Information for 2019

Here are the deductions at source rates for 2019 and 2018 for Employment Insurance, Quebec Parental Insurance Plan, Quebec Pension Plan (QPP), Canada Pension Plan (CPP), Quebec Health Services Fund and Commission des normes du travail. These rates will help the user plan more efficiently for the current taxation year and help to prepare T4 and Relevé 1 slips for 2018.

FL Fuller Landau Tax Partner Nick Moraitis Shares His Thoughts on the Fall Economic Update

FL Fuller Landau Tax Partner Nick Moraitis shares his thoughts on the fall economic update on CJAD 800. Temporary tax measures to assist News organizations over the next five years and new measures to encourage businesses to buy assets.

13th edition of the FL Fuller Landau Cedars CanSupport Dragon Boat Race & Festival saw over 500 paddlers take to the water

Download the PDF For Immediate Release, September 12, 2018, Montreal, Quebec, Canada The 13th edition of the FL Fuller Landau Dragon Boat Race & Festival, in support of the Cedars Cancer Foundation CanSupport program, took place Saturday at Parc Père-Marquette in Lachine and saw over 1,000 participants and spectators attend. Mother Nature was on the […]

New Quebec Tax Measure to Support Quebec Businesses

In an attempt to support Quebec businesses against the recently imposed tariffs announced by the Trump government in the United States, the Quebec government, on August 15th 2018, introduced two new measures, a temporary increase in the tax credits for investments in manufacturing and processing equipment and an acceleration in the reduction of Health Services […]

Our Top 5 measures from the 2018-2019 Quebec Budget

QST Foreign corporations: Tax fairness As of January 2019, foreign corporations without an establishment in Quebec, NETFLIX as an example, will be required to register and collect the 9.975% sales tax on taxable intangible goods and services to any consumers with a Quebec address. Moreover, Canadian corporations without an establishment in Quebec must do the […]

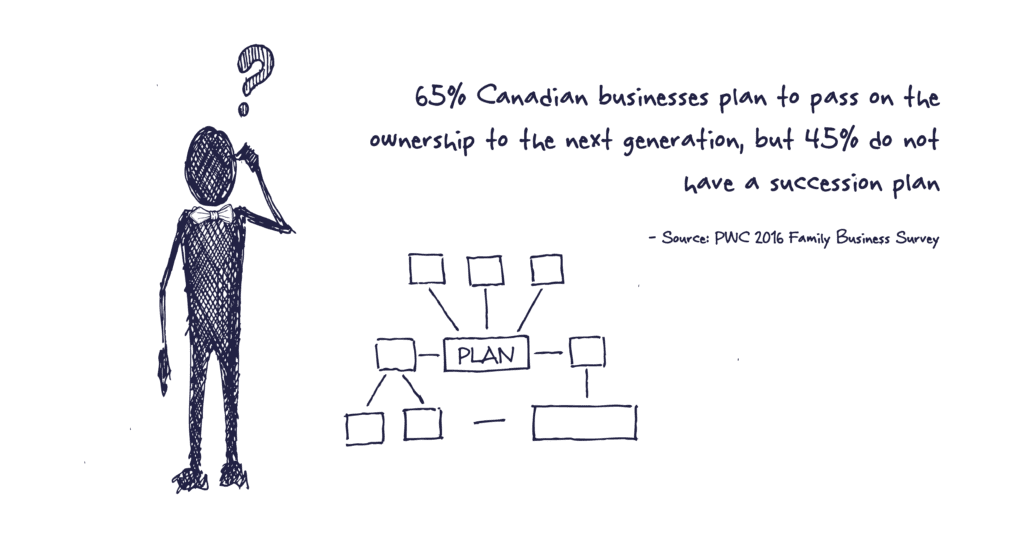

Family (Business) Matters

A family business or a family owned business may be defined as any business in which two or more family members are involved and the majority of ownership or control lies within a family (source: inc.com). 80% of all Canadian businesses are family-owned. But did you know that family businesses financially outperform non-family businesses? One […]

2018 CPA Recruit Award: FL’s Sara Halickman Stands Out Among her Peers

It is with great pleasure that we wish to announce that FL Fuller Landau’s Audit Manager Sara Halickman has been awarded the 2018 CPA Recruit Award of the Order of Chartered Professional Accountants of Québec. This well-deserved award recognizes Sara’s outstanding energy, determination and achievements, as well as her active contribution to the outreach of the CPA […]

Our Top 5 Measures from the 2018 Federal Budget

1. Refundable Corporate Taxes Under Canada’s corporate tax system, a portion of the tax that a corporation pays on investment income is refunded to the corporation when it distributes the income to its shareholders as a dividend. To eliminate perceived abuse by corporations that earn both business and investment income, the refundable tax system will […]

FL's Tax Partner Nick Moraitis shares his first thoughts on the 2018 Federal Budget on CJAD 800

The Honourable Bill Morneau, Minister of Finance, tabled the Liberal government’s 2018 budget on February 27, 2018. FL Fuller Landau’s Tax Partner Nick Moraitis shared his thoughts on CJAD 800 on The Aaron Rand Show and on The Andrew Carter Morning Show. The Aaron Rand Show – February 27, 2018 The Andrew Carter Morning Show […]

FL Fuller Landau’s Managing Partner Michael D. Newton earns FCPA Designation

It is with great pleasure that we wish to announce that FL Fuller Landau’s Managing Partner, Mr. Michael D. Newton has been awarded the title of Fellow of the Order of Chartered Professional Accountants of Québec. The title formally recognizes members whose exceptional dedication to the profession and achievements in their career and in the […]